This time, I want to talk about Bitcoin, not directly about tech, but still something very familiar to people in the tech field. Bitcoin is a type of digital currency that was unofficially introduced in 2008. Today, many countries around the world have legalized its use.

I am not a Bitcoin investor, but as someone interested in it, I decided to create this blog. When you think about it, the evolution of Bitcoin, its technological foundations, and the way people invest in it are truly fascinating.

From a tech perspective, the background technology that supports Bitcoin—the blockchain—is even more interesting. Nowadays, blockchain technology is being integrated into web technologies, which is a positive transformation for the web industry. In future blogs, I will also discuss the integration of blockchain with website technology.

In this blog, I will focus on Bitcoin itself and the concept of investment. Since Bitcoin was introduced unofficially in 2008, its value could not be precisely determined at that time. However, in 2010, 10,000 BTC was worth about $0.40. By 2011, 1 BTC equaled $1. That means within a single year, its value had increased by more than 10,000 times.

As of September 30, 2025, the estimated value of 1 BTC is over $100,000 USD. This is both astonishing and exciting, which is why I decided to write this blog. Here, I will explain Bitcoin and how one might approach investing in it purely as an educational resource, not as financial advice.

These explanations are based on estimates and should not be taken as actual investment results.

Unique Features of Bitcoin

Decentralisation

Decentralisation is the core essence of Bitcoin’s value. In simple terms, it means there is no single person, company, or government controlling Bitcoin. Therefore, Bitcoin is powered by a network of computers, known as nodes, spread all over the world.

These nodes work together to validate and record transactions. This ensures that Bitcoin operates freely, without any central authority calling the shots. Because of this decentralisation, it is a key factor that earns Bitcoin the trust of the general public.

Security and Privacy

When it comes to Bitcoin, security is a very important matter. Every transaction made is protected by cryptographic techniques, which means they are extremely hard to tamper with.

Bitcoin uses a type of encryption called public-key cryptography. Essentially, this means there is a pair of keys: a public key (which is like an address people can send Bitcoin to) and a private key (which is like a password that only you know).

If someone wants to steal your Bitcoin, they would have to guess your private key, which, thanks to advanced encryption, is practically impossible. However, in this advanced era, no system is 100% secure. Therefore, while Bitcoin cannot be claimed to be 100% secure, it is one of the most secure systems among the digital currencies of today.

Regarding privacy, whether you buy or sell Bitcoin, no one’s personal information is obtained or disclosed. You do not need to provide any information such as a Passport, National ID, Driving License, or E-ID, and you can easily collect, buy, sell, and invest.

Limited Supply

While 21 million is the predefined cap, Bitcoin’s divisibility introduces a fascinating nuance. Each Bitcoin is composed of 100 million satoshis (100,000,000 satoshis), making it highly granular. This is why Bitcoin can be compared to gold. Gold and other mineral resources are valuable because they are limited on Earth. Although Bitcoin is a digital currency that could theoretically be created endlessly, it was limited in this way to serve as a valuable unit. By having this limitation, Bitcoin becomes more valuable. This is another unique feature.

Blockchain-Based Technology

Bitcoin transactions use Blockchain-Based technology, which ensures transparency. Furthermore, due to the strength of Blockchain technology, no transaction can be modified. It is a system where you can exchange money globally just by having internet access. Because of the advanced nature and transparency of Blockchain technology, fraud is reduced to the extent that it cannot be performed.

How Bitcoin Works

Creating a Transaction – Imagine you want to send Bitcoin to someone. You have to use a digital wallet app. This is like a secure app on your phone or computer. When you start a transaction, your wallet creates a unique code. This code contains two parts: a Public key (like an address that can receive Bitcoin) and a Private key (like a secret password only you know). This is the stage where a transaction is created.

Sending Bitcoin – The person who wants to send you Bitcoin will get your public key as a QR code. They will scan that code and send Bitcoin to your wallet. They use their private key to approve the transaction, like signing a signature. This proves that they are the one sending the Bitcoin.

Verifying the Transaction – Now, the computers in the Bitcoin network (called nodes) will check this transaction. They will check if the sender has enough Bitcoin and if the same Bitcoin has been used twice (double-spending). Only if the check is successful can the process continue.

Processing the Transaction – Special computers called Miners combine your transaction with other transactions to create a block. This block is like a page in a digital ledger. It takes about 10 minutes to create one block containing many transactions.

Rewarding the Miners – The miner who finishes a block first receives some newly created Bitcoin as a reward. This reward is gradually reduced every 210,000 blocks. Miners also receive transaction fees paid by users. This process is called Proof of Work, and the miners are essentially solving a difficult puzzle to add a new block to the blockchain.

Transaction Completion – Once the new block (a chain connected to all previous blocks) is added to the Blockchain, your transaction is complete. This system is the fastest monetary system compared to the current fiat currency system.

This is a summary of how Bitcoin works. Looking at these mechanisms, it is clear that Bitcoin is the most transparent and secure monetary system.

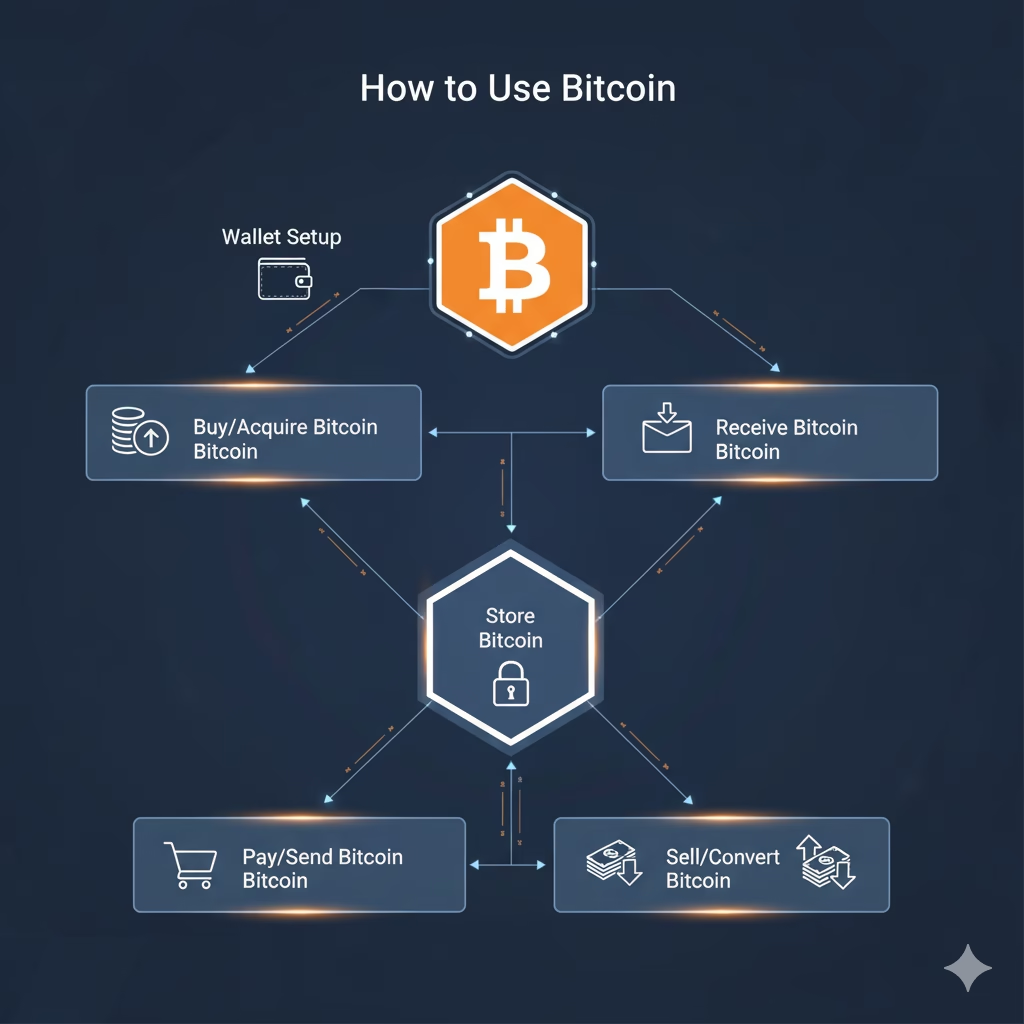

How to Use Bitcoin

1. Buying

You can buy Bitcoin by opening an account on a Crypto Exchange platform (such as Binance, Coinbase, Kraken, etc.) and successfully completing the KYC verification. You can use bank cards, wire transfers, or mobile payment systems to purchase Bitcoin with fiat currency. After buying, you must store it in your Digital Wallet. Buying is simple and can be completed instantly. However, when buying, you must choose a reliable type of coin.

2. Selling

You can sell Bitcoin back on exchanges and withdraw it as fiat currency. You can also sell it directly using the Peer-to-Peer (P2P) trading method. There are various ways to sell Bitcoin. What I’ve explained here is the global method. There are many traditional methods as well. Use the method that is convenient for you.

3. Investing

There are three main types of Bitcoin investment. The first is the Long-term holding (HODL) method. This method involves holding Bitcoin for a long period and selling it when the value increases. The second method is Trading. The value of Bitcoin, like global currencies, is not static. Therefore, trading is done based on the ups and downs of the price. This method is risky, so caution is advised. The last method is Diversification. This method involves combining Bitcoin with other crypto assets as a collective investment. This is also a safe method.

This concludes the four ways to use Bitcoin. Below, I will continue to talk about investing, which is one of the three methods.

Top Bitcoin Investment for 2025

1. Bitcoin Itself (BTC) — Still the Safest Bet

Bitcoin remains the most secure and decentralized crypto asset.

Institutional ownership is rising, especially through Bitcoin ETFs, which now hold over 27% of circulating BTC.

Analysts expect Bitcoin to reach $160,000 by late 2025, with some bullish forecasts pushing toward $1 million if strategic reserves are adopted.

The Bitcoin halving cycle (last occurred in April 2024) historically leads to price peaks 12–18 months later, aligning with Q3 2025.

Best for: Long-term investors, inflation hedging, portfolio stability.

2. Bitcoin Layer 2 Networks — Scalability & Speed

These networks build on top of Bitcoin to enable faster, cheaper transactions and smart contract functionality.

3. Bitcoin ETFs & Institutional Products

- Spot Bitcoin ETFs (like those from BlackRock, Fidelity) offer exposure without needing to hold BTC directly.

- These are regulated, liquid, and increasingly popular among traditional investors.

- 2024 saw record inflows into Bitcoin ETFs, a trend expected to accelerate in 2025.

- Best for: Passive investors, retirement portfolios, compliance-conscious businesses.

4. Tokenized Real-World Assets (RWAs) on Bitcoin

- Platforms are beginning to tokenize assets like bonds, real estate, and commodities using Bitcoin-secured networks.

- This bridges traditional finance with blockchain, a major theme for 2025.

- Best for: Diversified crypto investors and fintech entrepreneurs.

Bitcoin’s Projected Future: 2025 and Beyond

1. Robust Price Growth

- Bitcoin is expected to reach new all-time highs, with forecasts ranging from $143,000 to over $186,000 by the end of 2025.

- Long-term projections suggest Bitcoin could hit $500,000+ by 2030, driven by scarcity (only 21 million BTC), institutional demand, and global adoption.

2. Mainstream Financial Integration

- Major financial institutions are increasingly embracing Bitcoin through spot ETFs, custody services, and strategic reserves.

- Retail usage is expanding, with more merchants accepting BTC and fintech apps integrating Bitcoin wallets.

- Bitcoin is becoming a recognized asset class, similar to gold but more portable and programmable.

3. Technological Advancements

- Layer 2 networks like Lightning, Stacks, and Rootstock are improving scalability, enabling fast payments and smart contracts.

- Enhanced security protocols and wallet innovations are making Bitcoin safer and more user-friendly.

- Integration with AI and IoT systems could allow Bitcoin to power autonomous transactions in future tech ecosystems

4. Regulatory Clarity and Global Policy Shifts

- Countries like the U.S. are moving toward stablecoin regulation and clearer crypto frameworks, which indirectly support Bitcoin’s legitimacy.

- The GENIUS Act and similar legislation aim to integrate digital assets into national financial strategies.

- Some governments are even exploring Bitcoin reserves as part of their sovereign wealth strategies.

5. Sustainable Mining and Environmental Innovation

- Bitcoin mining is shifting toward green energy, with solar, hydro, and geothermal projects leading the way.

- New protocols and hardware are reducing energy consumption per transaction, addressing long-standing environmental concerns.

Final Thought

This blog shares educational insights about Bitcoin—its unique features and the ways people talk about investment approaches. Whether someone chooses to invest or not, the outcome depends on their own decision.

For those interested, it can be useful to learn from expert discussions and published insights, while many beginners historically start cautiously. The purpose here is not to give financial advice, but to highlight how Bitcoin’s decentralized system and blockchain technology have influenced the wider world of innovation.

These technologies have inspired many applications that benefit society, showing the broader impact that began with Bitcoin. This content is for educational purposes only and not financial advice.

Alice is the visionary behind Baganmmm Tech, a platform he founded with a passion for demystifying the complex world of technology. As the Lead Technologist, he's often found in his home lab – a cozy, wire-filled sanctuary where ideas are born and code is meticulously crafted. His infectious enthusiasm and knack for explaining intricate concepts make him the go-to expert for everything from web development to emerging tech trends.